Every CIO has had to face the CFO at one time or another in relation to a technology procurement decision. CFOs in particular seem to think that “IT always shows up, spouts unintelligible jargon and asks for huge lumps of cash”, to quote one consultant on CIO.com.

But the technology decision itself is just one component to consider. How to pay for it is becoming an additional and important element of that decision. Increasingly, there are a wide variety of flexible financing models emerging that effectively de-link the technology platform and the commercial model for CIOs to consider.

Many CIOs have a modest understanding of the benefits of accounting for technology investments as an operational expense versus a capital expense. Subsequently, CIOs fail to fully articulate the potential financial implications and benefits of using operating expenses to account for their technology investments.

CAPEX vs. OPEX

Simply put, capital expenditures tend to be major investments in goods, which show up on the balance sheet and are depreciated over the life of the asset, typically 3 years, whereas operating expenditure shows up on the profit and loss account and relates to expenses incurred on an ongoing basis.

Importantly for many organisations, operating expenses are better suited for organisations anticipating rapid growth or changes in technology requirements. Bernard Golden on CIO.com puts it another way, “Once you have purchased a capital good, you’re stuck with it, as anyone who has purchased a car understands; even if you’re no longer excited about owning it, the finance company still expects a monthly payment. By contrast, if you rent a car, you are committed to it only as long as you want to use it – and once you’ve paid for that use, you have no further financial obligation.”

The decision to select OPEX over CAPEX (or vice versa) as a way of recognising technology spending should be based on a better understanding of the role of capital expenditure within your company. Many organisations are limited by the markets or private lenders in the amount of capital expenditure they are able to access. Capital investment is limited, especially in these post-GFC financially conservative times. Therefore, organisations usually want to direct their investment toward revenue-generating activities. This is why many organisations prefer to lease rather than purchase — they don’t want to tie up precious capital. It’s easy to understand why any initiative that promises to reduce lumpy capital investment and transform it into smoother operational expenditure would be extremely attractive to the executive office.

Traditionally, an on-premise data centre was considered to be a capital expenditure since it includes the major purchase of a server (compute) and storage hardware, as well as software licenses. In addition, an on-premise data centre means the business will have to incur the direct costs involved with running a server: power, floor space, storage and IT operations, the indirect costs such as network and storage infrastructure and the overhead costs of owning a server including procurement and accounting personnel, along with IT management and attention.

Conversely, a data centre hosted in the cloud typically does not involve any major initial investments as the data centre is owned and managed by the provider, removing the capital expenditure associated with servers or data centres. Not only are you clear of the capital expenditure, you get to eliminate the operating expense associated with maintaining a data centre.

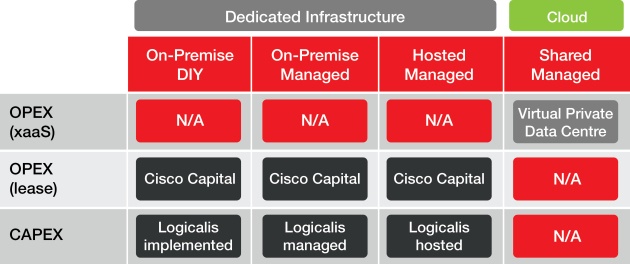

However this traditional view of IT expenditure is changing: it's no longer as simple as "on premise data centre = CAPEX and Cloud = OPEX". More flexible, OPEX funding arrangements are available across the full gamut of IT architectures from on-premise to hybrid and public cloud. On-premise or private cloud infrastructure can be leased, to provide an off balance sheet transaction. Combined with management, it provides the infrastructure and administration for a predictable monthly fee, and allows you to focus on core tasks. On-premise infrastructure combined with public cloud for non-core workloads, data protection and DR can all be all delivered via a true OPEX model, with a single monthly bill.

Selecting the right approach

Logicalis understands that no two businesses are alike. We offer a range of deployment models where you can choose the preferred operational model (cloud, hosted or on-premise data centre) and how to pay for it (OPEX or CAPEX). We recommend:

- We recommend firstly analysing what technology and applications are suitable to be moved to the cloud, based on total cost of ownership (regardless of the financing model) and which deployment model best addresses the business requirements (elasticity of demand, risk and performance). Many organisations - especially those with a more mature IT strategy - are finding a hybrid approach delivers the best of both worlds.

- Then, consider your organisation’s financial constraints to determine the most appropriate commercial model.

- Finally, undertake a financial analysis and understand the options on offer.

This enables you to make a recommendation that aligns to your organisations' preferred capital utilisation model.

We work closely with Cisco Capital to provide cost-effective OPEX (leasing) models, which can be structured specifically to suit your business requirements. With flexible repayment options, you can take advantage of the benefits of technology leasing, allowing you to use your capital to expand and grow your business.

Logicalis can work with you to provide the most appropriate financing model, regardless of the deployment model to help you maximise ROI.